Content Menu

● Understanding NAICS Codes

● Key NAICS Codes for PCB and SMT Industries

>> 334412 - Bare Printed Circuit Board Manufacturing

>> 334418 - Printed Circuit Assembly (Electronic Assembly) Manufacturing

>> 33441 - Semiconductor and Other Electronic Component Manufacturing

● Resources for Finding NAICS Codes

>> 1. Official Government Websites

>> 2. Industry-Specific Databases

>> 3. Professional Associations and Trade Organizations

>> 4. Government Agencies

>> 5. NAICS Code Lookup Tools

● Importance of Correct NAICS Code Selection

● Challenges in NAICS Code Selection for PCB and SMT Businesses

● Best Practices for NAICS Code Selection

● Impact of NAICS Codes on PCB and SMT Industries

>> Industry Trends and Analysis

>> Economic Indicators

>> Policy Making and Regulation

● Future of NAICS Codes in PCB and SMT Industries

● Conclusion

● FAQ

>> 1. What is the difference between NAICS codes 334412 and 334418?

>> 2. How often are NAICS codes updated?

>> 3. Can a PCB or SMT business have multiple NAICS codes?

>> 4. How do NAICS codes affect government contracts for PCB and SMT businesses?

>> 5. What should I do if I can't find an exact NAICS code match for my PCB or SMT business?

● Citations:

In the world of electronics manufacturing, printed circuit boards (PCBs) and surface mount technology (SMT) play crucial roles. For businesses operating in these sectors, understanding and correctly identifying their North American Industry Classification System (NAICS) codes is essential for various administrative, regulatory, and statistical purposes. This article explores the resources available for finding NAICS codes related to PCB and SMT industries, providing valuable insights for manufacturers, suppliers, and industry professionals.

Understanding NAICS Codes

NAICS codes are six-digit codes that classify businesses into specific business sectors[2]. These codes were developed to enable government agencies to track economic activity and have now found practical applications in various industries. The system is hierarchical, with each digit providing more specific classification:

- The first two digits signify the major group or sector (20 different industry sectors).

- The subsequent four digits further classify subsectors, industry groups, industry types, and industry by nation[2].

For PCB and SMT-related industries, several NAICS codes are particularly relevant.

Key NAICS Codes for PCB and SMT Industries

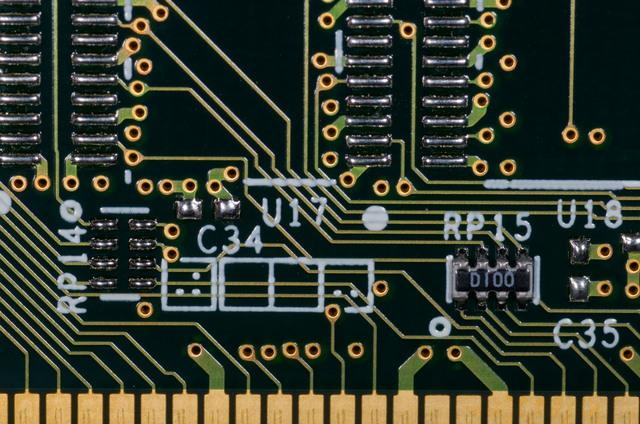

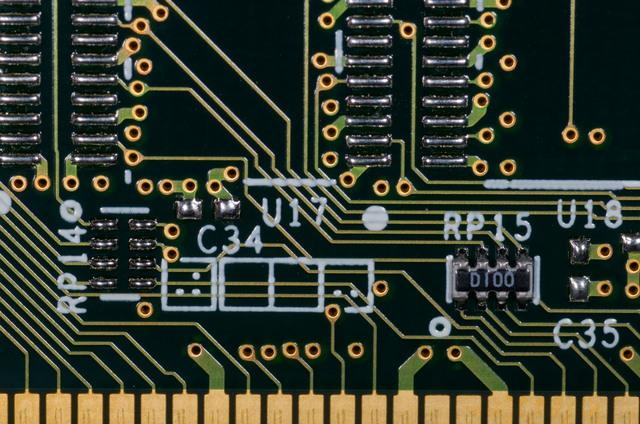

334412 - Bare Printed Circuit Board Manufacturing

This NAICS code specifically relates to establishments primarily engaged in manufacturing bare (rigid or flexible) printed circuit boards without mounted electronic components[7]. Activities under this classification include:

- Printing, perforating, plating, screening, etching, or photoprinting interconnecting pathways for electric current on laminates[7].

- Manufacturing of circuit boards, printed, bare.

- Production of flexible wiring boards, bare[7].

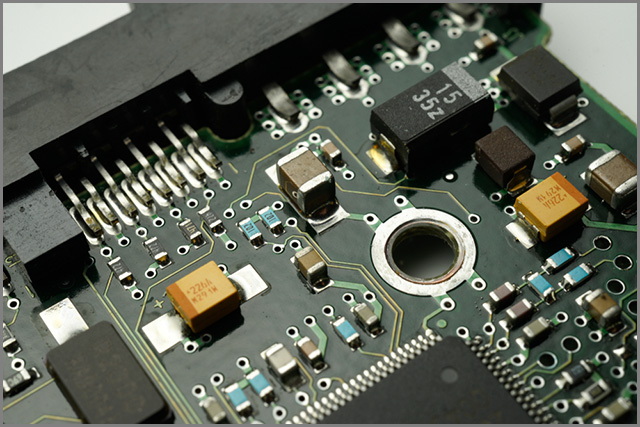

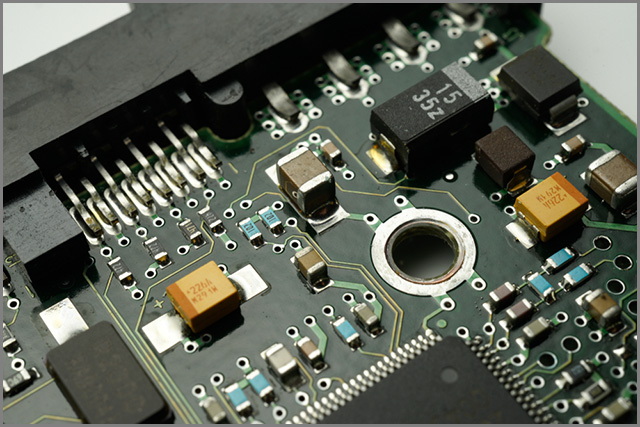

334418 - Printed Circuit Assembly (Electronic Assembly) Manufacturing

This classification encompasses establishments primarily involved in:

- Loading components onto printed circuit boards.

- Manufacturing and shipping loaded printed circuit boards[5].

- Producing printed circuit assemblies, electronics assemblies, or modules.

- Creating inputs for a wide variety of electronic systems and devices[5].

33441 - Semiconductor and Other Electronic Component Manufacturing

This broader industry group includes establishments engaged in manufacturing semiconductors and other components for electronic applications[3]. Products under this classification include:

- Capacitors, resistors, microprocessors.

- Bare and loaded printed circuit boards.

- Electron tubes, electronic connectors.

- Computer modems[3].

Resources for Finding NAICS Codes

Several resources are available to help businesses and professionals identify the correct NAICS codes for their PCB and SMT-related activities:

1. Official Government Websites

The U.S. Census Bureau's website (Census.gov/naics) is the primary and most authoritative source for NAICS code information[2]. It offers:

- An online search tool.

- Downloadable NAICS manuals.

- Extensive FAQs section.

Users can search for NAICS codes by keywords (e.g., "printed circuit board" or "electronic assembly") and drill down into specific categories to find the most accurate 6-digit code for their business[2].

2. Industry-Specific Databases

Websites like NAICS.com provide industry-specific information, including:

- Detailed descriptions of NAICS codes.

- Lists of top businesses within each NAICS category.

- Cross-references and related codes[3][5][7].

These resources can be particularly helpful for understanding the nuances between closely related NAICS codes in the PCB and SMT industries.

3. Professional Associations and Trade Organizations

Organizations representing the electronics manufacturing industry often provide guidance on NAICS code selection. They may offer:

- Industry-specific interpretations of NAICS codes.

- Assistance in determining the most appropriate code for member businesses.

- Updates on changes to NAICS classifications relevant to PCB and SMT manufacturers.

4. Government Agencies

Besides the Census Bureau, other government agencies use and provide information about NAICS codes:

- The Bureau of Labor Statistics (BLS) offers industry classification overviews and data based on NAICS codes[6].

- State-level departments of revenue or economic development may provide resources for businesses to identify their correct NAICS codes[8].

5. NAICS Code Lookup Tools

Various online tools and services offer NAICS code lookup capabilities:

- Some allow users to search by keyword or browse through hierarchical structures.

- Others provide crosswalks between different classification systems (e.g., SIC to NAICS)[6].

Importance of Correct NAICS Code Selection

Selecting the appropriate NAICS code is crucial for PCB and SMT businesses for several reasons:

1. Government Contracts: Many government agencies use NAICS codes to categorize and seek out businesses for contracts and procurements[1].

2. Industry Analysis: Accurate classification enables businesses to benchmark against industry standards and competitors.

3. Regulatory Compliance: Some regulations and reporting requirements are based on NAICS classifications.

4. Financial Services: Lenders and financial institutions may use NAICS codes to categorize businesses and assess industry-specific risks[2].

5. Statistical Reporting: Government agencies use NAICS codes for economic data collection and analysis, impacting policy decisions that could affect the industry.

Challenges in NAICS Code Selection for PCB and SMT Businesses

Despite the resources available, selecting the correct NAICS code can be challenging for PCB and SMT businesses due to:

1. Overlapping Categories: Some activities may seem to fit into multiple NAICS codes.

2. Evolving Technologies: Rapid advancements in electronics manufacturing may outpace NAICS code updates.

3. Diverse Product Lines: Companies producing a range of products might struggle to choose a single, most appropriate code.

4. Misinterpretation: Subtle differences between codes (e.g., 334412 for bare PCB manufacturing vs. 334418 for loaded PCB assembly) can lead to misclassification.

Best Practices for NAICS Code Selection

To ensure accurate NAICS code selection, PCB and SMT businesses should:

1. Thoroughly Research: Utilize multiple resources to understand the nuances of relevant NAICS codes.

2. Focus on Primary Activity: Choose the code that best represents the company's main revenue-generating activity.

3. Consult Experts: Seek advice from industry associations, accountants, or NAICS specialists when in doubt.

4. Review Periodically: As business activities evolve, regularly reassess the appropriateness of the assigned NAICS code.

5. Document Decision-Making: Keep records of why a particular NAICS code was chosen to ensure consistency in future classifications.

Impact of NAICS Codes on PCB and SMT Industries

The classification of businesses under specific NAICS codes has far-reaching implications for the PCB and SMT sectors:

Industry Trends and Analysis

NAICS codes enable the tracking of industry-specific trends, such as:

- Employment figures in PCB manufacturing (NAICS 334412) versus electronic assembly (NAICS 334418).

- Revenue trends across different segments of the electronics manufacturing industry.

- Geographical distribution of PCB and SMT businesses across regions.

Economic Indicators

Government agencies use NAICS-based data to produce economic indicators that impact the PCB and SMT industries:

- Production indices for electronic components.

- Import/export statistics for PCBs and related products.

- Investment trends in semiconductor and electronic component manufacturing (NAICS 33441).

Policy Making and Regulation

NAICS classifications influence policy decisions affecting the PCB and SMT sectors:

- Targeted tax incentives for specific manufacturing activities.

- Environmental regulations tailored to electronics production processes.

- Trade policies impacting the import/export of electronic components and assemblies.

Future of NAICS Codes in PCB and SMT Industries

As technology evolves, NAICS codes related to PCB and SMT may need to adapt:

1. Emerging Technologies: New categories might be introduced to accommodate advancements in flexible electronics, printed electronics, or integrated smart systems.

2. Convergence of Industries: The lines between traditional PCB manufacturing and other electronics production may blur, potentially leading to new hybrid classifications.

3. Increased Granularity: Future revisions might introduce more specific codes to differentiate between various types of PCB and SMT manufacturing processes.

4. Global Harmonization: Efforts to align NAICS more closely with international classification systems could impact how PCB and SMT businesses are categorized.

Conclusion

Finding and correctly applying NAICS codes related to PCB and SMT industries is a critical task for businesses in this sector. The resources available, ranging from official government websites to industry-specific databases and professional associations, provide valuable tools for navigating the NAICS classification system. By understanding the nuances of relevant codes like 334412, 334418, and 33441, PCB and SMT businesses can ensure accurate classification, which is essential for regulatory compliance, industry analysis, and accessing business opportunities.

As the electronics manufacturing landscape continues to evolve, staying informed about NAICS code updates and best practices for classification will remain crucial. By leveraging the available resources and adhering to best practices in NAICS code selection, PCB and SMT businesses can position themselves effectively within their industry classification, contributing to more accurate economic data and potentially benefiting from industry-specific opportunities and insights.

FAQ

1. What is the difference between NAICS codes 334412 and 334418?

NAICS code 334412 specifically refers to Bare Printed Circuit Board Manufacturing, which involves the production of unpopulated PCBs[7]. In contrast, NAICS code 334418 covers Printed Circuit Assembly (Electronic Assembly) Manufacturing, which includes loading components onto PCBs and manufacturing fully assembled circuit boards[5].

2. How often are NAICS codes updated?

NAICS codes are typically reviewed and updated every five years to reflect changes in the economy and industry structures. The most recent major update was in 2022, with previous revisions in 2017, 2012, and 2007[6].

3. Can a PCB or SMT business have multiple NAICS codes?

Yes, a business can have multiple NAICS codes if it engages in diverse activities. However, for official reporting purposes, companies are usually classified under their primary business activity. It's important to identify the code that best represents the main source of revenue or central operations[2].

4. How do NAICS codes affect government contracts for PCB and SMT businesses?

Government agencies often use NAICS codes to categorize and identify potential contractors for specific projects. Having the correct NAICS code can be crucial for PCB and SMT businesses to be considered for relevant government contracts and to ensure compliance with size standards for small business set-asides[1].

5. What should I do if I can't find an exact NAICS code match for my PCB or SMT business?

If you can't find an exact match, choose the code that most closely aligns with your primary business activity. You can also contact the Census Bureau at naics@census.gov for assistance in determining the most appropriate code. Additionally, industry associations or professional NAICS code services can provide guidance in selecting the best-fit code for your specific business activities[2].

Citations:

[1] https://www.fscpsc.com/naics-codes/334412

[2] https://www.nav.com/blog/check-your-naics-codes-8163/

[3] https://www.naics.com/naics-code-description/?code=33441

[4] https://www.abc.org/Membership/MasterFormat-CSI-Codes-NAICS-Codes/CSI-Codes

[5] https://www.naics.com/naics-code-description/?code=334418

[6] https://www.bls.gov/ces/naics/

[7] https://www.naics.com/naics-code-description/?code=334412

[8] https://dor.wa.gov/about/statistics-reports/sic-and-naics-codes

[9] https://www.bls.gov/oes/2023/may/naics3_334000.htm